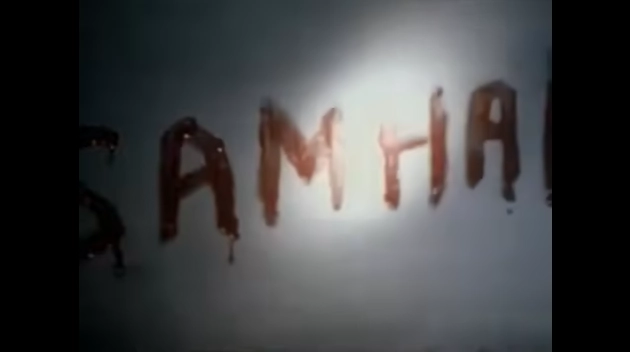

If one must describe the current stock market in a single sentence, it would be this:

At five in the morning, the sun's first light is already visible, yet its warmth is still not felt.

We all know that the sunrise typically occurs around 6 o'clock, and most people can feel the light and warmth only by 7 or 8 in the morning.

It is often said that the night before dawn is quiet and still.

The so-called "five o'clock sun" is one where only a faint light is seen, without the sun itself being visible.

To use the stages of the stock market as a metaphor, it is the transitional time from the end of a bear market to the beginning of a bull market.

This requires time, a process, and certainly will not happen overnight.

Just like when the night is over but the day has not yet risen, the sky before dawn is not only quiet and still, but in some places, it is a bit dark.

You could say that some high-quality stocks have already hit bottom and started to climb together.

It can also be said that there are still some stocks that have not yet exploded in terms of "bombs" and there is still a significant room for decline.The index is in the bottom range, repeatedly fluctuating, and individual stocks are starting to show a clear path of differentiation between the strong and the weak.

The reason why dawn feels different to people is because some live on the mountaintop, while others live in the valley, and the time they see the sun is different.

What you need to do is to focus on the strong and discard the weak, trying to look for the high points of the mountain.

Standing in different places, you can already see different scenery.

This is why some people think the market is very unattractive, while others think there are many opportunities in the market, because what they see is different.

The transition from the end of a bear market to the beginning of a bull market is a process, and this process is bound to be very long.

The main reason for its length is actually several.

First, the market needs to engage in competition and sedimentation.

The alternation of bull and bear markets is a natural law, but it is also the result of competition.In simple terms, a large amount of capital sells off stocks, while another large amount of capital buys stocks.

Bulls and bears engage in repeated battles at a certain point or within a certain range.

Until the capital that is bearish completely exits the market, and the capital that is bullish secures enough shares.

The game of capital in the stock market is not achieved overnight, because the two sides of the game do not know the situation of the other side.

Those who want to buy do not know whether they can buy stocks at a lower price, nor do they know how many stocks the other side wants to sell.

Those who want to sell do not know whether they can sell stocks at a higher price, and how much the other side really wants to buy stocks.

The two sides are in a process of repeated game and confrontation.

In this situation, there are also many speculative short-term funds that come in and out, forming short-term fluctuations.

The back and forth fluctuations, repeated games, will eventually precipitate, and the shares will slowly return to a reasonable state, and the market will also complete the alternation.

This is like a balance of supply and demand for buying and selling, which will tend to a new balance in continuous transactions, which is nothing more than a matter of a range of points and a time period.Second, the market is waiting for the implementation of policies.

The implementation of policies takes time.

Each new bull market will have many policies implemented.

This is how we have the National Nine Articles, the new National Nine Articles, and policy reforms every ten years.

Many people think it's a policy to save the market, but it's not.

The market's reform every ten years is like our ten-year plan, everything is arranged in advance.

So, the market's capital will match the policy to play the game, and the policy will become a key to the transformation of the bull and bear market.

Of course, from each policy introduction to the arrival of the bull market, there will still be a cycle.

Because the capital introduced by the policy needs time to enter the market.

Third, the market needs the chips at the bottom.The transition between a bull market and a bear market is essentially a change in the holders of the chips.

The key to this lies in four words: bottom chips.

This bottom is certainly not the absolute bottom, but a bottom range.

998 is just a point, but 998-1300 is a range.

1664, 1849, 1949 are all points, but these points to 2200 points are a range.

Including 2440-2646 is also a range, not a specific point.

The market needs bottom chips because bottom chips are a basic condition for making profits in a bull market.

The big hand that controls the market also comes to make money, and the essence of making money in the stock market is to have enough chips at a low enough price.

Fourth, the market is waiting for the differentiation of strength and weakness.

After a round of bull and bear market, some stocks are on the brink of death, while some stocks are high up.The essence of the alternation between bull and bear markets is the survival of the fittest in the market.

Funds also cluster in bear markets, choosing the direction they believe to be better to cluster.

The differentiation between the strong and the weak also requires time, as well as fluctuations.

You will find that some stocks have actually bottomed out early and have been rising in the fluctuations.

Another part of the stocks is still looking for the so-called bottom, on the road of endless decline.

Whether it is a bull market or a bear market, it is a market where the strong are always strong. The fundamentals seem unimportant, but they are the key to crossing the bull and bear.

Time and space are both indispensable.

Nowadays, the downward space has not been completely opened, so it still needs to be polished a little in time, and wait.

It is said that time is exchanged for space, and this sentence must be correct.

Since the market is eager to bottom out at 2635, it dares not challenge the super resistance zone of 3300-3700 points in the short term.Just let it oscillate within the box at the bottom, and digest the chips clean.

It's like many people don't believe in dawn because they haven't seen the sun, so let them go down the mountain at this time.

The reason why the process is long is that there are too many things to do, and the prelude to a bull market takes a long time.

You can review several rounds of bull markets in the market, and the essence is actually the same.

The adjustment from 1992 to 1995 opened the bull market from 1996 to 2001.

The adjustment from 2002 to 2005 opened the bull market from 2006 to 2007.

The adjustment from 2010 to 2013 opened the bull market from 2014 to 2015.

The adjustment from 2016 to 2018 opened the bull market from 2019 to 2021.

Without a long cycle adjustment of 3-4 years, a bull market cannot be conceived, because the time cycle is not enough.It's as if in a 24-hour day, nearly 12 hours have to be night, which is a law of the Earth's rotation.

Some people say that this alternating time is garbage time, very much a waste, and it's normal not to make money.

For retail investors, whether it's grinding the bottom or building the bottom, they can skip it directly without participating.

It's like, if you understand that the market is in a bear market of a large cycle, then wait patiently.

In a 5-8 year cycle, make a round of the bull market and make a round of money, why bother in the bear market.

You can also enjoy the process of waiting for the sunrise, which is both long and interesting, allowing us to see a lot of things clearly and grow in the market.

Perhaps in the eyes of a hundred people, there are a hundred different stock markets.

But it doesn't matter, because the stock market, like this world, is colorful and makes people feel completely different.

Join the Discussion